Will Continuous Disney Layoffs Crash their Happy Brand Image?

The name that remains synonymous with joy and effortless execution is facing brand marketing issues primarily stemming from massive internal Disney layoffs to a string of not-so-great movies and the struggle to drive its streaming business toward success. Continuous layoffs are not just a business challenge—they’re a hit to employment rates, diversity, equity, inclusion (DEI) efforts, and the economy, especially in today’s inflationary climate. Bob Iger’s return to Disney in 2023 came with a heavy price: 7,000 job cuts to save $5.5 billion.

The reality is that Disney needs to act fast on many fronts to restore its positive outlook. Let’s dive deep into the problems affecting Disney’s market performance and brand image.

Continuous layoffs are more like a crash landing on the employer’s branding

Disney is grappling with its most pressing challenge now: its employer branding. To understand where it all started, we need to rewind a bit. The layoffs that have tarnished Disney’s image have been a recurring theme since Bob Iger’s return as CEO. In 2023, he decided to cut over 7,000 jobs, a move aimed at saving billions. But it didn’t stop there. The layoffs continued into 2024, hitting Disney employees twice this year alone, all under the banner of cost-cutting and boosting profit margins.

What’s alarming is Disney’s aggressive approach to reducing its workforce. And it’s not just the parent company feeling the impact—our beloved Pixar (now Disney-owned company) slashed 14% of its workforce in July 2024.

The most recent round of layoffs came after Disney’s third-quarter results for 2024. In a statement addressing the latest cuts, a Disney spokesperson said, “We continually evaluate ways to invest in our businesses and more effectively manage our resources and costs to fuel the state-of-the-art creativity and innovation consumers value and expect from Disney. As part of this ongoing optimization work, we have been reviewing the cost structure for our corporate-level functions and have determined there are ways for them to operate more efficiently.”

More than 130 employees were let go, and another 300 were handed pink slips in September. If you’ve been on LinkedIn lately, the flood of goodbye posts from Disney employees paints a clear picture of the situation.

While the rationale seems rooted in efficiency and cost reduction, the constant job cuts are leaving a deep dent in Disney’s employer brand—raising questions about the long-term impact on its workforce morale and the company’s standing in the industry.

Times are tough, but revenue is pouring — what’s the issue?

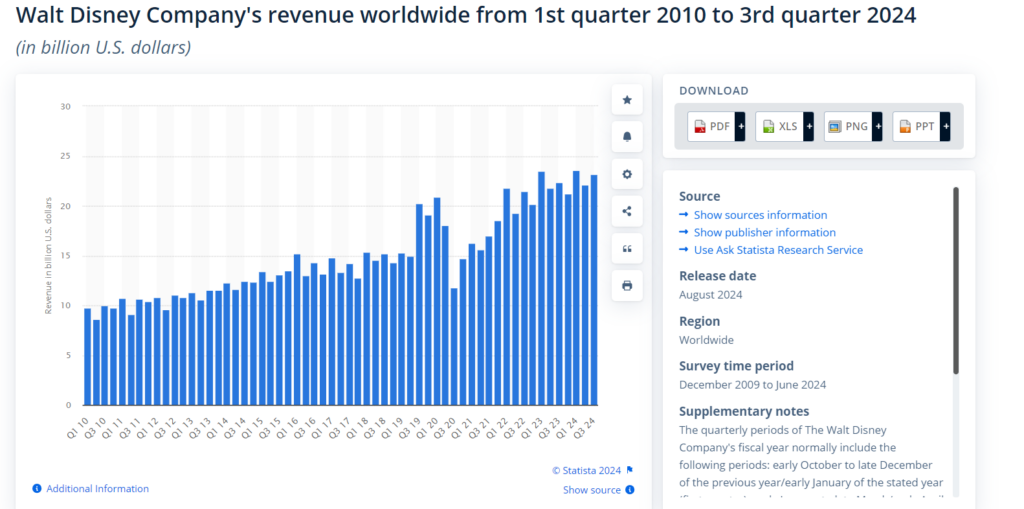

Times may seem harsh for Disney, but a quick glance at its revenue stats tells a different story—at first glance. Disney’s total revenue is up 4%, reaching a solid $23.16 billion, and its operating income has jumped by an impressive 19%. So, what’s the issue, you ask?

Digging deeper, it becomes clear that Disney’s real challenge isn’t in the overall numbers but the details. For instance, their theme parks, which are historically one of their most robust profit centers, could perform better. Operating profit for the parks has dipped by 6%, which is a red flag for the brand since these parks are a significant part of Disney’s identity and revenue stream.

Meanwhile, the company’s movie division got a much-needed boost with the success of Inside Out 2, which knocked it out of the park and reignited some excitement for Disney. However, this spark seems fleeting when you look at their Disney+ streaming service, which has become a focal point for the brand’s future growth. Despite gaining 800,000 new subscribers in the US and Canada, the platform lost 100,000 international subscribers, keeping the overall glow-up muted.

Subscribe to our bi-weekly newsletter

Get the latest trends, insights, and strategies delivered straight to your inbox.

In short, Disney’s enigma lies in its mixed performance across various sectors. Streaming, theme parks, and blockbuster movies make up the core of Disney’s empire, and while some areas show growth, others are underperforming. That balance—or imbalance—is the real challenge for the “house of mouse” right now.

Layoffs will not go away soon if the entertainment economy doesn’t solve the streaming crisis ASAP

Entertainment giants like Disney, Paramount, and Warner Bros. are trapped in a cycle, chasing the allure of becoming the next Netflix.

Streaming was supposed to be their golden ticket, their answer to the evolving digital age. But here’s the kicker: the dream of becoming the next Netflix is proving to be more of a pipe dream than a reality. The subscription fatigue is real, and consumers are less willing to shell out monthly fees for multiple OTT services, especially with inflation biting and unemployment rising. It’s about more than just producing endless content anymore; it’s about whether consumers can even afford to tune in.

Of course, there’s the ripple effect: fewer subscribers equal fewer eyeballs on ads. Advertisers? They’re feeling the pinch. Less ad space means less revenue for these streaming platforms, which in turn leads to cost-cutting measures like—surprise, surprise—layoffs. It’s a vicious cycle, a self-sustaining crisis.

At this point, it’s like the industry’s own version of “Hunger Games,” where the survival odds for these companies trying to become the next Netflix seem smaller by the day. Instead of finding new ways to innovate, the focus shifts back to squeezing more from less, all while leaving their workforce to bear the brunt.

Cut to the chase

Disney’s downfall after continuous layoffs may not seem close yet, but the impact and price are heavy on everyone. From employer branding to failing streaming services and angry advertisers, the recovery for Disney is a long path.