The Power of Vegan Food Brand Marketing

Vegan food brand marketing is next level. Would you buy a chicken burger without chicken? Or a pack of cheese without milk? Maybe – if it’s sold right. Welcome to the world of mindful eating, where plants are the new meat, and dairy is taking a backseat to all things nutty, soy-based, or oat-powered.

Let’s break it down—veganism in the U.S. only claims about 1% of the population, while the vegetarian crowd holds a modest 4%. So, if we’re talking numbers, that’s a pretty small slice of the pie. It makes you wonder: have these vegan brands uncovered some marketing miracle? Or are they just fighting tooth and nail over that elusive 1% of full-time vegans?

Let’s talk about what veggie brands are getting right – and how all brands can learn from their marketing genius.

Veganism and veggies are not a passing health trend

While it might seem like plant-based diets are a “cool” thing, the influx of clean food serves a larger audience. For many folks, it’s not about jumping on a bandwagon of a specific diet—it’s about overall health. Some people are allergic to common ingredients like meat, honey, or dairy, which allows plant-based foods to thrive, with science backing their rise.

Vegan food brands aren’t just catering to vegans. People who can’t (or don’t want to) consume certain animal products make up a significant part of their customer base. Then remember the power of Gen Z influencers that have turned “mindful eating” into a full-blown movement. Whether it’s sharing recipes, grocery hauls, or making trendy dietary changes, these influencers have helped plant-based diets shine.

So, pigeonholing vegan food brands to a niche market of 1% vegans doesn’t add up. These brands have smartly broadened their appeal, marketing to anyone seeking healthier or alternative food options. It’s about being inclusive, not exclusive, and that’s why vegan products are claiming their fair share of the food and beverage market.

Vegan food brands are no longer just about what’s inside the product

They’re shaping culture, pushing boundaries, and going beyond the traditional F&B aisle. Take Liquid Death, Meati, and NotCo, for example. Each of these brands isn’t just innovating with ingredients; they’re mastering the marketing game with their innovative products and unique strategy around marketing.

Liquid Death is canned water. Just water. But they’re making headlines with bizarre, bold ads and collaboration with artists and partners. This year, they teamed up with Amazon Prime’s The Boys, featuring Chace Crawford (AKA The Deep) in a hilarious, off-the-wall ad. They’ve even partnered with Eminem for his Houdini video, and, in addition, NASCAR has announced Liquid Death as the official iced tea for pro drivers. Their bold, sometimes bizarre approach is drawing attention from all sides.

View this post on Instagram

Though its marketing might seem aimed at Gen Z and Gen Alpha, Liquid Death doesn’t just box itself into a single demographic. With its Instagram posts and ad campaigns, the brand embraces inclusivity, blending age, race, gender, and attitude into one cohesive message: fun, non-alcoholic, and for everyone. It’s not just about selling water anymore—it’s about creating a lifestyle and community that’s quirky, cool, and refreshingly unexpected.

Meati, on the other hand, is carving its path in the alternative protein market by harnessing the power of mycelium—yep, mushrooms! The brand is about creating non-animal meat, but they’re not going all-in on the general plant-based craze. Instead, they’ve found a niche within the vegan sector, focusing on alternative proteins. It’s a clever move, especially considering that this year was quite a rollercoaster for Meati, raising $100 million in funding while facing a false advertising suit over its mushroom roots claim.

Despite the bumps, Meati has ambitious plans—raising $1 billion over the next five years. They’re taking a strategic approach, leveraging the growing demand for unique protein alternatives without fully diving into the saturated plant-based market. Meati’s marketing tactic is also intelligent: focusing on influencers, from macro to micro, to spread the word among nuclear families, bachelors, and the younger generation. It’s all about reaching the right crowd with the right message.

While newer brands like Liquid Death and Meati are making waves in the vegan market, even legacy giants like Kraft Heinz are seriously interested in the plant-based sector. Enter Kraft Heinz’s NotCo, a brand shaking things up with its quirky innovation and futuristic approach to vegan food. But what sets NotCo apart isn’t just its dedication to cruelty-free products—it’s AI chef Guiseppe.

Guiseppe helps create sustainable ingredients, revolutionizing how we think about plant-based foods. NotCo is carving out its niche by using this AI to make tasty, animal-free food that doesn’t compromise flavor. With a brand identity rooted in creativity and cutting-edge tech, NotCo is positioning itself as a forward-thinking, sustainable alternative for conscious consumers.

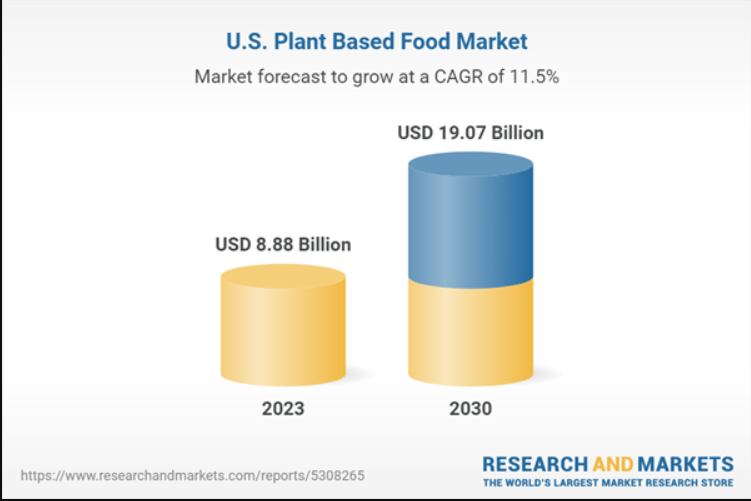

Does the growth stat show signs of success for vegan food brands?

Absolutely, yes! The current market scenario is quite promising. Vegan food brands are on a growth trajectory, with the market projected to rise from US$18.94 billion in 2024 to a whopping US$28.20 billion by 2034. An increasing preference for plant-based foods drives this shift as more people switch from animal products to sustainable, guilt-free alternatives.

One key factor contributing to this surge is the high consumption of fast food in places like the United States. Americans, on average, indulge in fast food 1-3 times per week, spending a jaw-dropping $160 billion annually. Vegan brands are tapping into this trend, offering plant-based fast-food alternatives that appeal to health-conscious and eco-friendly consumers.

Despite all the hype, plant-based foods accounted for just 1.1% of total retail food and beverage sales in 2023.

The slower adoption of vegan diets also stems from factors like limited availability in specific locations, higher costs of vegan recipes and raw materials, and concerns over the nutritional value of some plant-based products. While the market is growing, there’s still a long way to go in making vegan food accessible, affordable, and nutritionally sound as mainstream options.

Cut to the chase

Vegan food brands are expanding into the F&B industry. Still, they’re not just trying to stay under the radar—they’re making bold moves to capture attention in a crowded market, especially with the high demand for fast food.