The Streaming War in 2026 is about Urgency, not Growth

Before 2026 even dawned, the Academy Awards announced its move to YouTube streaming for its 101st award show in 2029. The contract is signed for five years. Netflix vs. Paramount is far from over, and Warner Bros. is taking its sweet time before making any decisive moves.

Taken together, these developments signal something bigger than one-off distribution deals. The streaming war is no longer about audience habits or ad tiers. It’s reshaping the entire entertainment ecosystem. Linear TV, despite experts insisting on its survivability, continues its downward slide. With every new Gauge report, Nielsen has effectively been throwing more towels into the ring.

At the same time, streamers have rediscovered their appetite for “events.” And they’re not moving slowly. With urgency, ad revenue, and attention all at stake, platforms are shifting pieces aggressively and without pause. That context makes one thing clear: the streaming war of 2026 deserves a closer look.

Domination of streaming platforms in 2025 was consistent

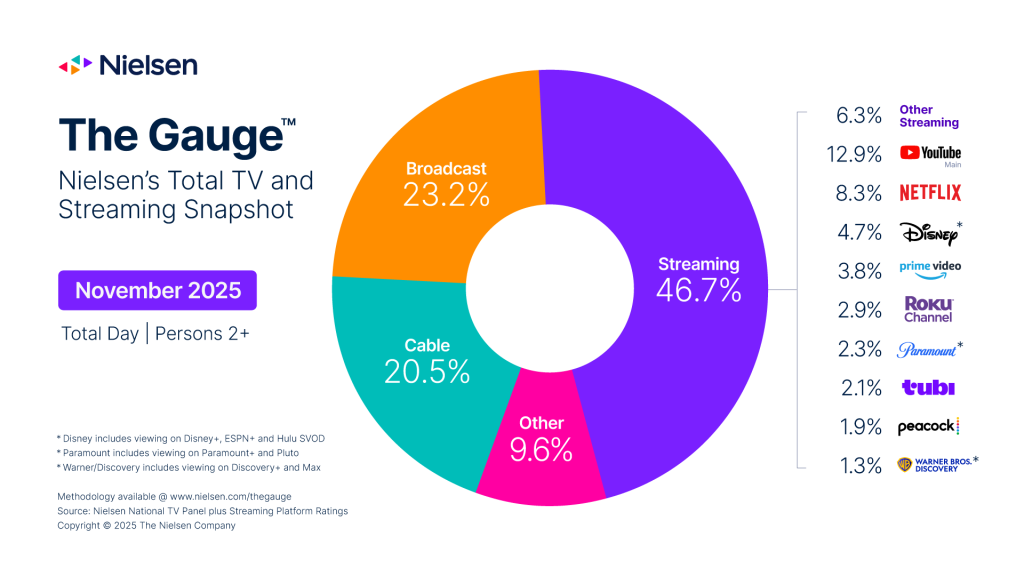

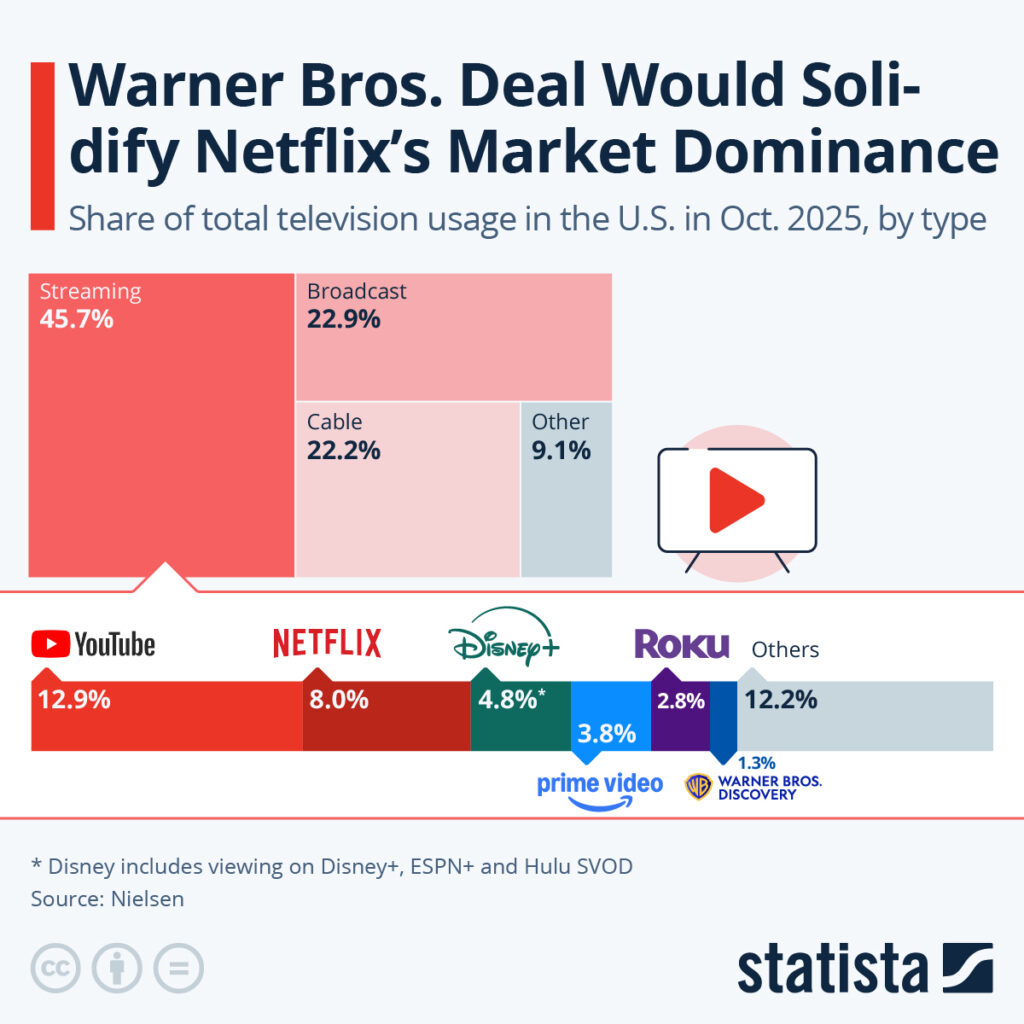

Throughout 2025, streaming platforms steadily eclipsed linear TV in Nielsen’s Gauge reports. In June, streaming accounted for 44.8 percent of total TV usage. By November, that figure had climbed to 46.7 percent.

More importantly, this wasn’t a temporary spike. Industry leaders broadly agree that the upward trajectory is unlikely to reverse. Recent shifts in broadcast and cable contracts further reinforce the idea that YouTube-led live streaming now holds more promise than traditional ABC-style airtime.

“The idea that linear will ‘bounce back’ is more wishful thinking than a viable strategy,” Peter Hamilton, Head of Ad Innovation at Roku, wrote on LinkedIn. “In the last year alone, primetime broadcast ratings fell by over 15 percent, and U.S. pay-TV households dropped below 50 percent for the first time ever,” he added.

Linear TV isn’t disappearing overnight—it’s evolving into something very different from the broadcast-and-cable model we’ve known for decades. But that broader transformation is a conversation for another day. What matters here is the direction of travel, and the evidence is stacking up fast. One of the clearest signals is the rising number of live events migrating to streaming platforms.

The Oscars’ new contract with YouTube accentuates that shift. It hints at a future where live events—award shows, music ceremonies, and cultural tentpoles—stream exclusively on digital platforms rather than airing on ABC, a legacy television network.

Streaming platforms competing with big screens

The pressure, however, isn’t limited to traditional TV. Theatres and studios are also feeling the squeeze. The looming merger involving Warner Bros., with its destination still uncertain, has raised fresh questions about the future of the big screen itself.

Against this backdrop, Netflix pushed itself into the spotlight with a high-profile presser welcoming Warner Bros. into the fold. Almost immediately after those emails went out, Paramount countered with a hostile bid.

Hollywood circles campaigned heavily against the deal. Their anxiety centered on shrinking theatrical windows and the long-term erosion of box-office viewership.

Subscribe to our bi-weekly newsletter

Get the latest trends, insights, and strategies delivered straight to your inbox.

Still, from Netflix’s perspective, acquiring Warner Bros. is highly crucial. Audience retention, subscriber growth, and premium ad placements all hinge on scale and content depth. Why?

Competition within streaming is reaching a fever pitch. YouTube’s dominance is impossible to ignore. Commanding roughly 12.9 percent of total TV usage, it stands as the single largest player in the streaming landscape. Netflix follows in second place, capturing around 8 percent.

And that’s where the core of the streaming war sits.

Desperation of streaming platforms

Despite continuous growth, streaming platforms are not slowing down. They are pushing ahead, and that momentum signals desperation. Even with massive audience bases, platforms are in a hurry not to lose users. In the digital world, loyalty is fragile. No user owes any platform for long-term commitment.

That reality makes retention paramount. Every quarter becomes a fight to hold ground. Netflix’s desire to acquire Warner Bros. exposes darker patterns: bundled content, tighter control over IP, monopolized access, and reduced competition.

HBO Max may be a relatively newborn compared to decade-old streaming giants, but it brings something many rivals lack—deep, globally recognizable original IP stacks. A Harry Potter HBO series and IT: Welcome to Derry are franchises with built-in audiences that Netflix would have gladly claimed as its own.

As the second-place holder in Nielsen’s ratings, Netflix must defend its position next year. That pressure is intensifying, especially as flagship originals like Stranger Things and Squid Game have already run their course.

Replacing YouTube remains wishful thinking. Nothing dislodges that elephant easily. But if Paramount secures control over Warner Bros. and its original IPs, Netflix could see its growth story stall—both in ratings and subscriber momentum.

Backpedaling on live events

Acquiring studios is one play. Streaming live events is another. Netflix is attempting to sail both boats at once. Another sign of desperation is the industry’s return to live events. Streamers have quietly accepted an inconvenient truth they spent a decade ignoring.

Binge drops train audiences to watch eventually, not immediately. That model optimized convenience but sacrificed cultural relevance. In 2026, streamers are backpedaling. They’re chasing live premieres, weekly episode drops, sports, award shows, reunion specials, and creator-led live streams—anything that forces audiences to show up at the same time.

Last month, the Jake Paul vs. Anthony Joshua boxing match drew an estimated average minute audience of 33 million Live+1 viewers globally, according to VideoAmp and Netflix.

That figure, however, still fell short of the platform’s earlier live-event peak. The Mike Tyson vs. Jake Paul fight reportedly pulled in 108 million viewers.

An “event” creates scarcity in an ecosystem built on infinite choice. It spikes social chatter, reduces churn, and gives advertisers something predictable to buy into.

Cut to the chase

The streaming war isn’t being fought for love, loyalty, or even innovation. It’s being fought for attention, timing, and cultural relevance. Linear TV’s gravitational pull is weakening. The first quarter of 2026 will reveal the peak of desperation and attrition of the streaming industry.