Publicis Vs WPP is Ethical or Exposing. Find Out

There has been a face-off between two prominent (Holdco) agencies for a while. Publicis vs. WPP has gained so much attention in the headlines that every marketer (from the C-suite to junior level) is biting their nails at the next surprise.

It is clear to all of us. WPP is on a losing streak, and Publicis doesn’t hint at stopping anytime soon. While the developments are happening, the question at the core of all is—what drives this rivalry between two mammoths?

To make sense of all of it—or maybe some of it—we are going to dive deep into it. We will explore the causes and aftermaths, and if we are lucky enough to survive all the tests, we may conclude it on revealing terms for you.

The tip of the iceberg that started Publicis vs WPP

At the end of Q1 2025, Coca-Cola moved its North American business to Publicis from WPP. This could be the first table-turning instance in Publicis vs WPP.

With that occurrence, the major accounts that contributed more to WPP businesses, such as Mars and Paramount, leaned towards Publicis. With its $1.7 billion account, Mars hopped on the Publicis train. Paramount ended its more than two decades of relationship with WPP and shook hands with Publicis.

What was once a solid fortress of legacy clients for WPP is suddenly porous. There are speculations, but the truth is largely the truth. The client shake-up in WPP happened because of the late adoption of digital and AI tools, holding on to investment, and siloed services. In short, WPP struggled to fully modernize.

| Publicis | WPP | |

| 2024 Spend | €100 m | £250 m (~€290 m) |

| 2025 Budget | €300 m/year | £300 m (~€350 m) |

| Acquisitions/Partnerships | Lotame, Captiv8, Epsilon, Sapient | InfoSum, Stability AI; Google Cloud, Nvidia |

| Platform Strategy | Unified CoreAI across data, media, creative | Modular WPP Open with integrated partners |

The context behind the table is to show you with numbers. Publicis vs WPP has opened the floodgate of discussion on martech and adtech investment. It is significant to keep an eye on stats while believing in hearsay.

While Publicis has a razor-focused, high-scale AI platform (CoreAI) backed by consistent acquisitions and over €12 billion in cumulative investment, WPP is methodically building out its modular WPP Open system with targeted acquisitions and tech partnerships, but still trails Publicis in platform cohesion and scale.

Brands that decided to ditch the WPP over Publicis because Publicis, with its integrated Power of One model, looks more nimble in comparison, especially for clients looking for digital-first, data-backed strategies.

WPP fired shots at Publicis over Epsilon’s performance

WPP’s jab at Publicis over “low-effort ad inventory” was a thinly veiled shot at Epsilon—Publicis’ $4.4 billion acquisition from 2019.

Subscribe to our bi-weekly newsletter

Get the latest trends, insights, and strategies delivered straight to your inbox.

Public fighting among Holdco companies is unusual but not unheard of. Once WPP realized its shrinking position in the market, jabs were thrown at the opponent. Last resort to save the skin, a kind of tactic?

Epsilon offers data-driven, programmatic ad targeting, and while it’s helped Publicis grow its digital muscle, critics (looking at WPP) accuse it of pumping out “low-quality” placements, implying quantity over creativity or relevance.

WPP’s side-eye here was strategic: it’s trying to stir doubt among marketers about trusting automation and data-driven personalization as the centerpiece of campaigns. But when the market was already steering away and cheering for your competitors, saving face with rants does not work.

Publics vs WPP set the stage for Mark Read’s departure

There was a lot of murmuring about WPP and the head of the agency, Mark Read. After marking a losing streak, Mark Read had to act. Swearing on AI advancement in WPP’s martech and adtech technologies, Read couldn’t save the biggest accounts. The next step was predictable.

On 9th of June, the company announced that Mark Read will be retiring at the end of 2025 after more than 30 years with the company. His departure as CEO of WPP is being read as both a symptom and a cause. Internally, it signals WPP’s struggle to maintain creative dominance and client loyalty in a shifting media ecosystem.

Externally, it paints a picture of a leadership crisis just as rival Publicis celebrates wins. Read, who had tried to push a more connected, tech-forward WPP, has hit resistance from legacy systems and impatient shareholders. His exit might be the final nudge for clients questioning the direction and stability of the agency giant.

While focusing on WPP’s shortcomings in the ongoing rivalry, we should also hear what market peers say about Publicis.

Tea on Publicis through the public space

It’s impossible to ignore Publicis’ momentum. In recent years, and even more so in the past few months, the agency’s trajectory has only gone one way: up.

From snatching marquee accounts like Mars, Coca-Cola (NA), and Paramount, to positioning itself as an AI-first, data-rich holding group, Publicis has made itself look almost… untouchable.

But when there’s too much shine, it’s fair to squint.

Sure, Publicis is collecting praise, headlines, and high-profile wins. But in an industry where work-life balance is often an afterthought and holding companies squeeze out every ounce of productivity, it’s naïve to think Publicis is the exception.

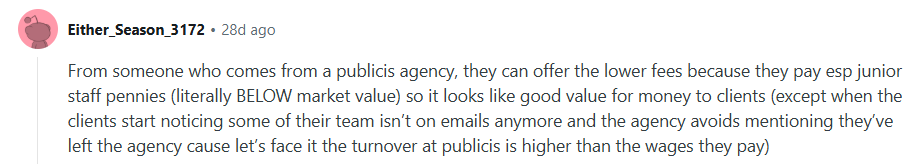

At digital platforms, whispers tell a different story. Complaints around undercutting smaller agencies and creative freelancers surface often, especially when Publicis swoops onto a pitch and lowballs to win, allegedly without regard for margins or industry balance.

The RTO backlash is real, too. Employees have posted vague return-to-office rules and low junior-level wages, with some saying they were promised flexibility only to be called back with little warning.

Another topic that’s gained traction? Client loyalty cycles. Brands jumping ship from one holding group to another isn’t new—Mars, for example, was once with Publicis, then with WPP (FKA GroupM), and now it’s back with Publicis.

So, how do you separate facts from frustrated venting? You don’t ignore the wins but keep an eye on the spin. Publicis may be winning the business headlines, but behind the scenes, it’s still part of the same high-pressure game all holding companies play.

Cut to the chase

Publicis is on a winning streak, snatching major accounts like Mars, Coca-Cola NA, and Paramount straight from WPP’s roster. WPP, in response, is calling out to Publicis to push low-effort ad inventory. The industry is watching a full-blown agency war unfold with Mark Read’s retirement.