FAST Channels Are Booming—But Is the Attention Span There?

With subscription fatigue, viewers anticipated that the streaming wars would come to an end. Instead, they have taken a new direction, and that model has become ad-supported. Free Ad-Supported TV (FAST) channels are experiencing a boom in viewership and engagement from brands. Roku, Samsung TV Plus, and Amazon’s Freevee are all buying into the boom, and traditional networks are racing to catch up.

But there is a caveat: FAST channels might be booming in distribution and revenue, but the attention spans of audiences have never been shorter. This tension begs the question that every advertiser is asking—are FAST channels really about long-term engagement, or just the latest shiny object in a crowded and confusing streaming environment?

We will unpack why FAST channels are booming, evolving audience behavior, and what that means for advertisers. We will examine everything from opportunity to challenges, and if this boom serves more as temporary attention than substantial engagement.

What are FAST channels, exactly?

FAST channels are free, ad-supported streaming services which present linear programming over the internet with a schedule. Essentially, they are cable TV renewed for the streaming age. Viewers get “always on” channels across genres, shows, or themes without a subscription fee.

Pluto TV (one of the first FAST channels) built its empire on this premise. Today, Pluto has hundreds of channels from crime dramas to niche anime marathons—all fueled by ads. Similarly, Samsung TV Plus built an ad-supported model into its smart TVs that quickly pulls in viewers who don’t want to manage multiple subscription fees.

For advertisers, four words sum up FAST channels’ potential: they deliver television-sized audiences, offer measurable digital performance, and cost viewers nothing—even as many feel “subscription tapped.”

Why are FAST channels thriving, and why is everyone jumping on the fast train?

There are multiple market forces that are contributing to the expansion of FAST channels:

- Subscription fatigue: Households in the United States already subscribe to four or more paid streaming services. And those costs add up, sparking interest in free options.

- Built-in access: Many smart TVs are now preloaded with a host of FAST channels, making them easy to discover. By the way, Samsung TV Plus requires zero sign-up, further contributing to instant gratification.

- Ad budgets are shifting back to TV-like formats: Advertisers are enjoying the lean-back experience offered by FAST, which mimics the old format, allowing ad brand recall and association to be stronger than in other fragmented or skippable online formats.

- An abundance of content: Studios/distributors are licensing massive amounts of “long tail” content to FAST providers. It feels like 20 years later, old repeats of Baywatch or Top Gear could now have a new life and new ad inventory available at a low cost.

And it works. Variety’s 2024 FAST Market Report reported that U.S. FAST ad revenue will top $12 billion by 2027, growing more than both SVOD and AVOD.

The attention span problem (Tug-of-war)

The early success of FAST channels seems promising; however, here is where it gets complicated. Audiences today don’t consume content like they did during the golden age of cable.

We now live in a TikTok-driven attention economy where 6-second hooks dictate whether the content will live or die. Netflix has even revealed in its own internal testing that viewers can make a decision about whether or not to continue watching a title after as few as 90 seconds.

Subscribe to our bi-weekly newsletter

Get the latest trends, insights, and strategies delivered straight to your inbox.

And let’s not forget: younger audiences will make that number even smaller since they’ve learned to scroll, not watch. What happens when FAST channels, based on “always-on, linear-like” streams, encounter viewers that have been trained to select when, what, and the manner in which they watch?

What is lean-back vs. lean-forward viewing?

One way of looking at it is that FAST isn’t fighting against short attention spans – it’s serving a completely different use case. FAST channels are all about discovery, not choice; Netflix needs a user to choose something to watch, FAST channels provide a lean-back style to discover what you will occupy your couch with.

For instance, a Roku user is not lighting up a FAST channel to binge on a new series. They lit up a FAST channel because they wanted some passive entertaining background while they were preparing dinner. This slow, discovery-lean-back experience is like the way old cable used to deliver experiences. This isn’t about hyper-engagement; it’s about companionship.

The trade-off? Whatever measurement change advertisers applied, their eyes would have to think about attention differently, by thinking about ambient engagement. A 30-second spot in a FAST channel may not always have found itself in front of an audience who was engaged with the television screen, but it definitely always found itself in front of a relaxed (and engaged) audience.

Recent noteworthy fast and furious moves

FAST channels are more than just multiplying – they’re experimenting, reconfiguring, and paving all sorts of new pathways in realtime. Between Amazon’s shoppable TV experiments and Warner Bros. Discovery’s bending of premium shows into ad-supported ecosystems, things are changing very quickly. For advertisers, it’s an indication that the playbook is still being written.

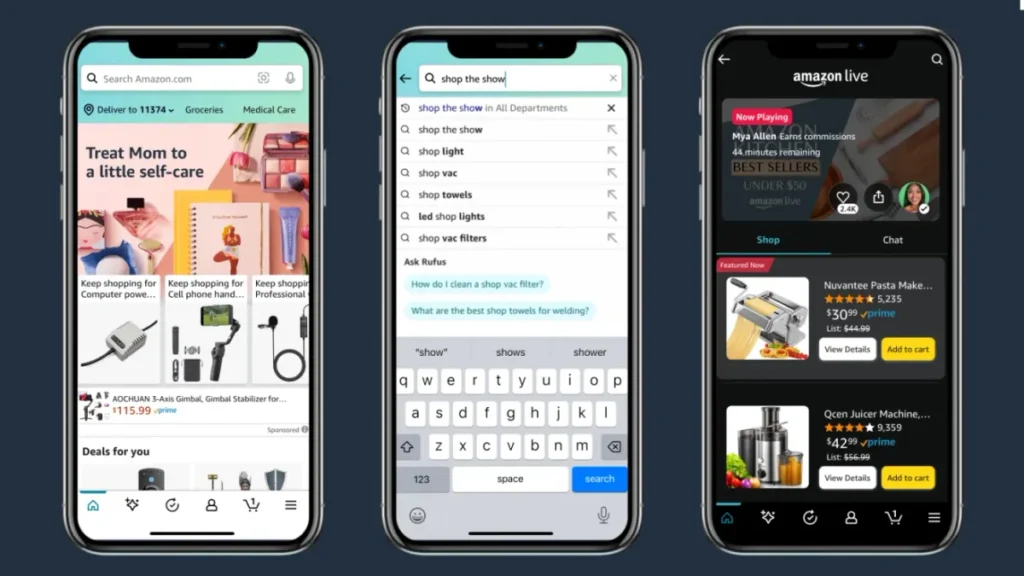

Amazon’s shoppable FAST channel experiment (2024–25): Amazon introduced a shoppable, free ad-supported FAST channel in Prime Video and Freevee, merging commerce, creator content, and lifestyle programming into a “shop the show” experience starting in 2024.

Warner Bros. Discovery FAST licensing pivot: WBD has been pivoting legacy shows including Westworld, Raised by Wolves, The Nevers, and FBoy Island to the FAST ecosystem — for instance via Tubi’s new WB-branded FAST channels.

Niche FASTs and curated channel bets: Platforms including The Roku Channel, Pluto TV, Samsung TV Plus, and Amazon Freevee are embracing genre-specific FAST channels, including news, lifestyle, food, or kids’ programming — allowing brands to cost-effectively reach highly-targeted audiences.

All of these activities represent the same trend: advertisers chase audiences who want free, familiar, and frictionless content.

What advertisers need to keep in mind

The opportunity is huge, but not without some challenges. Here’s where marketers should focus their efforts as FAST channels continue to grow:

1. Attention is Not Guaranteed: Unlike TikTok or YouTube Shorts, FAST viewers are not locked in. They may get distracted, may walk away from the screen, or jumping around channels frequently. Dwell time, co-viewing households and ad recall are all metrics of importance, NOT completion rates.

2. Data Fragmentation: Every FAST platform (from Samsung to Roku to Pluto) is in its own ecosystem. When advertisers are looking at fragmented reporting, figuring out their own ROI across the platforms is difficult. Calls for standardized measurement (with leadership from Nielsen and Comscore) are becoming more vocal across the industry.

3. Content Quality Truly Matters: Not all FAST viewing is created equal. With nostalgia keeping the model afloat for a long time, WANs (viewers) are not going to live on endless rerun programs forever. Advertisers need to look for fast programming companies that are spending money on original or exclusive FAST-first programming.

4. Younger Audiences are More Challenging: FAST isn’t growing fastest among younger households, taking the biggest share of 35+ households. Gen Z viewers tend to prefer short, interactive (gaming) experiences. When marketers aim to reach younger audiences, pairing with social amplification may still be required to allow for relevance when connecting with younger audiences.

Rethinking what ‘attention’ really means

This is the paradox: despite shorter attention spans, people consume more content than ever. FAST channels fit this paradox because they are not competing with TikTok but rather claiming the space of radio—always on, always there, and not necessarily always requiring total attention.

Advertisers’ opportunity is not to chase hyper-attention but to maximize frequency, relevance, and brand recall in these passive contexts.

Let’s say your brand is running during cooking shows in a food-focused FAST channel on an always-on basis—it is not about one big impression but rather building brand equity through habitual and subconscious exposure.

So, is attention span real?

The answer is no, not in the way old school TV advertisers will want. FAST channels are not promising the binge-level immersion of a wired streaming show or the hyper-focus of short-form video. And that is okay.

Instead, they are very strong in ambient attention, household reach, and scale, which is rare in today’s fragmented media landscape. For brands, whether they recognize the differences and adapt campaigns accordingly.

FAST channels are on the rise, and the big reason why can be boiled down to the simplicity of streaming: turn it on, sit back, and enjoy, for free. In a world with choice fatigue, that simplicity may be what keeps them successful, even if the attention span isn’t at its peak.

Cut to the chase

FAST channels are not about seeking binge-worthy attention, but rather owning the ambient moments viewers experience every day. The boom has arrived, but the smart move is knowing how to show up where viewers are most receptive. Are you prepared to put your brand in the fastest lane?