Navigating CTV Measurement Without Nielsen: The Great TV Currency Shift

Nielsen’s panel-only currency is on borrowed time. By the end of 2025, it will be retired, marking one of the most consequential shifts in TV and CTV measurement in decades.

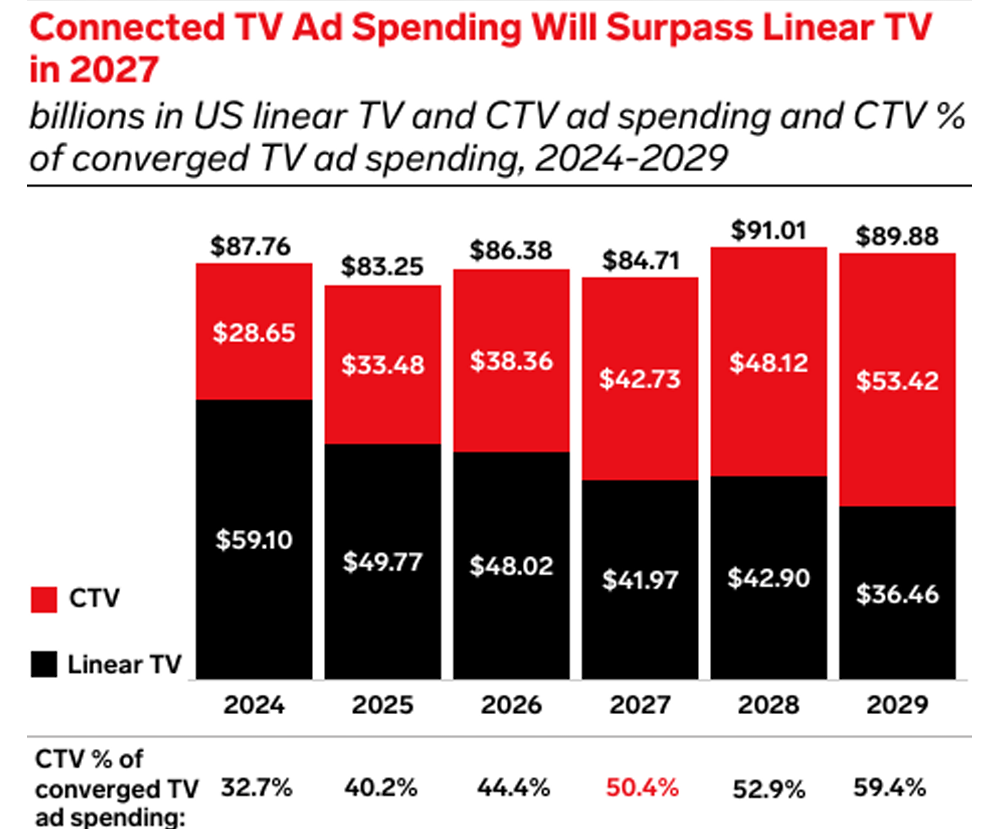

With connected TV (CTV) expected to account for 40.2% of the $83.25 billion advertisers will spend on linear and CTV combined this year—and nearly a fifth of all media spend—the stakes are high, reported by eMarketer.

For advertisers, the moment is about rethinking how they track audience reach, attribution, and ultimately, performance across an increasingly splintered media landscape.

The question on every marketer’s mind: If Nielsen’s old currency is going away, what’s next? And how do brands navigate this shift without burning their budgets or missing out on audience insights? Let’s dig in.

Nielsen’s panel-only model can’t keep up

For decades, Nielsen’s panel-based approach was the bedrock of TV measurement. A representative sample of households was tracked to extrapolate viewership across markets—a system that served its purpose in a linear, appointment-viewing world.

Now, that system is outdated.

According to eMarketer’s data, the number of CTV viewers in the US surpassed linear TV viewers in 2024. By 2027, ad dollars flowing to CTV are projected to eclipse those going to linear television altogether.

Advertisers are reallocating budgets because CTV offers real-time signals and better targeting options that traditional methods can’t match.

Yet the shift is about preferences as well as survival. Viewers today consume content across dozens of platforms and devices. Even large events like award shows or live sports now have fragmented audiences.

Advertisers need measurement tools that can track incremental reach, frequency, and attribution across screens—not just a snapshot based on a static panel.

Sticking to legacy models risks turning TV ad spend into guesswork.

Big Data, Smart TVs, and Set-Top Boxes are rising stars

With Nielsen’s retirement looming, the measurement market is scrambling to fill the void. But it’s not just new players rushing in—Nielsen itself is reinventing its approach.

Its Big Data + Panel measurement solution blends set-top box analytics and smart TV signals with panel insights, offering a hybrid view that addresses scale and accuracy.

Other players, including smaller networks and tech-driven measurement providers, are leaning heavily into alternative currencies powered by data from connected devices. These include:

- Set-top boxes tracking live viewing behavior

- Smart TVs feed anonymized, household-level engagement data

- Streaming services provide granular interaction metrics

- Third-party data providers offering demographic overlays and audience clustering

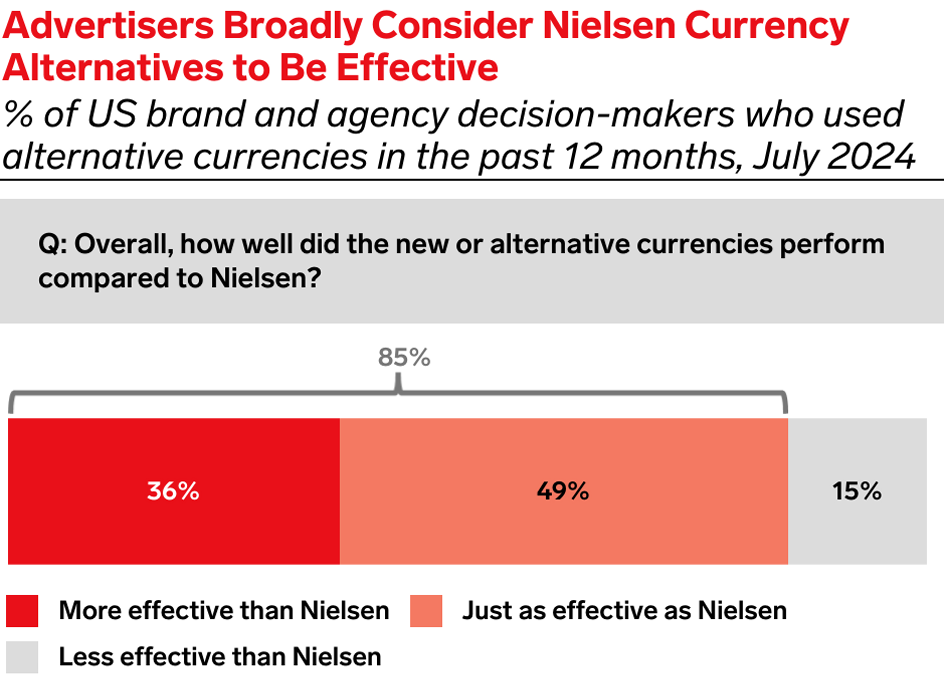

Advertisers who experimented with alternative currencies over the past year found them promising. 85% of advertisers surveyed by Advertiser Perceptions reported that alternatives were “on par or better” than Nielsen’s legacy model. Yet, the advertisers hesitate in switching.

The price of switching: scale vs. innovation

Why not switch wholesale? Why cling to a system that’s clearly outdated?

The answer boils down to scale and cost.

Switching measurement providers isn’t plug-and-play—it involves new transaction infrastructure, auditing standards, and negotiation models. Nielsen’s reach among major networks still dwarfs newer solutions. Even if alternative currencies offer better precision in some markets, advertisers fear that incomplete data will fragment their reporting, complicate media planning, and drive up costs.

This becomes especially apparent during upfront negotiations, where advertisers lock in their ad spends for the coming year. With Nielsen’s legacy currency phasing out in Q4 2025, networks and advertisers alike are preparing to transact using a mix of measurement solutions.

But unless an advertiser has already transitioned, they’ll be stuck negotiating prices amid uncertainty.

As eMarketer’s report highlights, linear TV remains a nearly $50 billion market this year. Advertisers can’t abandon it overnight, even if the tools used to measure its performance are out of step with today’s fragmented viewership.

A road to a multicurrency marketplace for CTV measurement

If the past few years have proven anything, it’s that a single currency won’t suffice. Digital advertising has operated in a multi-currency environment since its inception. Whether it’s tracking impressions, clicks, conversions, or interactions, marketers have long juggled diverse data sources to build campaign insights. Converged TV measurement is simply catching up.

Nearly 64% of US brand and agency decision-makers agree that publishers who don’t invest in currency interoperability risk falling behind. As converged TV accelerates toward digitization, cross-platform measurement demands flexibility, transparency, and adaptability.

Spot-level metrics, audience clustering, and probabilistic modeling are being refined to suit cross-media attribution. Multicurrency ecosystems are emerging not just because of technological progress but because consumer behavior demands it.

The ability to stitch data from set-top boxes, smart TVs, and streaming platforms into a coherent measurement framework is becoming a baseline expectation.

The real challenge is governance and standardization. Who audits the data? Who sets benchmarks for comparability? Which networks commit to openness? The coming months will reveal whether measurement players can build trust as fast as technology advances.

Attribution must evolve in a multiscreen world

One of the biggest blind spots in current TV measurement lies in how outcomes are attributed.

Traditional last-touch attribution, where credit is assigned to the final interaction before conversion, severely underestimates CTV’s contribution. Even as interactive and shoppable ads become more widespread, most purchases or conversions happen on other devices days or weeks later.

CTV’s strength is not always direct conversions—it’s brand awareness, consideration, and audience conditioning. Its impact ripples across customer journeys in ways last-touch models fail to capture.

That’s where advanced attribution methodologies like:

- Multitouch attribution – weighing multiple exposures over time

- Incrementality modeling – identifying which ad interactions drove lift beyond natural behavior

- Marketing mix modeling (MMM) – assessing how different channels work together

Advertisers need to shift from asking “What did this campaign directly drive?” to “How is this campaign influencing the overall customer journey?”

Cut to the chase

Post-Nielsen, the next currency won’t be a one-size-fits-all solution. A CTV measurement system will be a network of interoperable tools, models, and methodologies that reflect the messy, dynamic reality of modern media consumption. Embracing multiple currencies isn’t about jumping on a trend—it’s about staying relevant in a world where audience behavior, devices, and content formats have outpaced legacy tools.