Culture Over Carbonation: Unpacking Liquid Death’s Demise in the UK

For many months, marketing experts and pundits have covered Liquid Death’s failure in the UK and explored its reasons. Liquid Death’s journey is quite an interesting case study for brands that may see the UK as a potential market for themselves.

Liquid Death saw an uptick in its sales and popularity simultaneously in the US market, whereas the company pulled back from the UK in just a year. In 2024, Liquid Death appeared in our top-vegan companies list with bizarre and bold ads and collaborations with artists and partners.

The 4Ps—Product, Price, Place, and Promotion—of marketing are the foundation for establishing any brand in a market. Were the 4Ps of Liquid Death in the right sections? What happened at the supermarket on London’s busiest road? What made Liquid Death fail in the UK market?

Now, we must dive deep into the brand’s journey, which faced challenges in a new territory after its launch.

The timeline of Liquid Death highlights the trajectory of the brand

Mike Cessario, a former Netflix creative director, established Liquid Death, a canned-water brand in the bottled water market. Liquid Death’s revenue topped the charts in 2023 and 2024, with the company making $263 million and $333 million, respectively.

The unique marketing approach of Liquid Death positioned it as an emerging punk rock essential for Gen Z and Millennials in the US. Through social media posts and ad campaigns, the brand embraced inclusivity, blending age, race, gender, and attitude into one cohesive message: a fun, healthy, sustainable bottled water brand for everyone.

In 2023, the brand expanded and debuted in the UK. London is known for being a powerful force in shaping the punk movement, which was fueled by social and political unrest. Introducing a punk rock–themed Product in Britain sounds very profitable—until it is not.

So, was that a cultural misfit? No and yes. In short, it’s not quite simple.

Liquid Death UK Failure is in the 4Ps and more

Liquid Death will not be the last brand that mistook all 4Ps of a marketing playbook. Currently, we have Liquid Death as a prime example to talk about the basics of marketing due to its course in the UK.

Liquid Death was an unexpected storm brewing amid the bottled water industry. The product is canned water. It is sustainable because there is no plastic. It is for everyone. It is aesthetically pleasing to the eyes, so good-for-grams.

At the end of every possible argument, Liquid Death is canned water, which makes it unimpressive in the UK market. The novelty wears off fast when the core offering doesn’t stand out in terms of taste, value, or cultural relevance. The bold branding might grab attention, but doesn’t always convert into loyalty, especially when consumers don’t feel connected to the product.

Liquid Death may have leaned too far into shock value without offering a compelling reason for repeat purchase in a market that values heritage, authenticity, and practicality.

Availability of a free alternative

Why? First, the UK has tap water, and not just any tap water, highly regulated and trusted tap water. In 2022, England reported 99.97% compliance with drinking water standards, while Scotland, Wales, and Northern Ireland followed closely at 99.91%.

Selling canned water in a market where clean, free water is available could be tough for any brand. And Liquid Death faced a significant challenge because of that. When consumers already have easy access to safe drinking water at home, work, or in public places, a premium-priced, single-use product becomes a harder sell. The question becomes: why pay for water when you don’t need to?

Also, you cannot cap a can like you do with bottles. You have to drink the contents in one go, or you’ll throw away the money you put in. That’s not ideal for people on the move or those who like to sip slowly.

Another P in the pickle is price

Liquid Death in Tesco is £5.50—that’s $7. Evian, a competitor brand in the Tesco aisle, is around £4.50. It’s a clear failure written in the purchase receipts. Why did Liquid Death choose to put such a premium price tag on canned water when there is free water?

There must be a gap in market research. There is inflation in the UK market. Prices in the UK rose by 2.6% from 12 months to March, less than in the previous month but still above the Bank of England’s target. And this is a current report from the BBC. Where the cost of living has risen, nobody can expect customers to make impulse purchases. Pricing needs to reflect the environment in which consumers live. A product positioned as edgy and fun can’t ignore the reality of tightened wallets.

In the UK, premium pricing for water, no matter how cool the can looks, can come off as tone-deaf when basic utilities are already straining budgets.

Placement is another fiasco

Hustle reported that Tesco put the cans of Liquid Death in the beer aisle. Funny, isn’t it? Drinking beer is a regular habit for Brits, and if you’ve put a water can in that aisle, nobody will pick it up.

Beer beats everything.

The UK has a strong pub culture, and social drinking is deeply embedded in daily life. From after-work pints to weekend pub crawls, alcohol is not just a beverage but a social ritual. So, when shoppers browse the beer aisle, they’re not looking for hydration but a buzz.

Placing a can of water mimicking beer branding beside actual beer only adds to the confusion. It might catch the eye, but it also risks being ignored entirely because it’s in the wrong context for what consumers are there to buy.

For Liquid Death, that shelf placement was more a marketing misfire than a smart visibility play.

Promotion faded without impact

Liquid Death is a viral brand and Product in the US market. There is no deniability in promotion. However, replicating the same promotion in the UK did not work. Social media is still not an entirely credible or wide-reaching channel to influence mainstream buying behavior in the UK.

Tesco, Co-op, Amazon—every major retail partner tried to capitalize on Liquid Death’s previous viral success. But there was no strong local push, and TV promotions were not part of the marketing mix. And that’s a mistake.

Television remains one of the UK’s most trusted and far-reaching advertising channels. According to Ofcom’s 2023 Media Nations report, 82% of UK adults still watch broadcast TV weekly, and trust in TV ads remains significantly higher than trust in social media ads. Meanwhile, only 38% of UK internet users trust ads they see on social media. That matters.

While viral Instagram and TikTok campaigns may set the tone, they don’t always convert into mass-market trust and buy-in, especially in a country where traditional media still holds weight.

Liquid Death might have gone loud on social media, but it wasn’t visible where it mattered in the UK.

A promising future awaits after the Liquid Death UK failure

Liquid Death spent $7 million on the Super Bowl 2025 ad. The ‘safe for work’ campaign went viral overnight. The brand is now witnessing a skyrocketing trajectory in sales and revenue. Much of the credit goes to social media influencers, creators, partnerships, and bold digital campaigns. Digital media has played a powerful and undeniable role in building Liquid Death’s momentum.

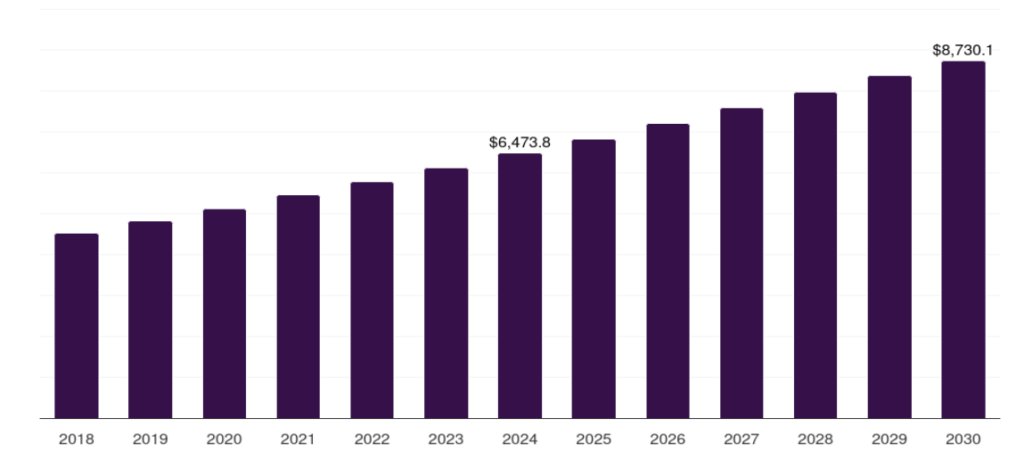

The UK bottled water industry is bright and expected to grow exponentially.

While we’re not removing the positives, the brand must reflect on the gaps in market research before entering additional territory. Understanding culture is not optional—it’s essential. Creating loyal customers will remain challenging without putting effort into making a product culturally relevant.

The UK setback isn’t a dead end; it’s a valuable lesson in how global success depends on local insight.

Cut to the chase

Liquid Death debuted in the UK market but pulled back from the territory after a year. The company has not made any official remarks on the matter, but we list the reasons, and trust me, the Product is not the issue.