Meta Advertising Takes a Dangerous Slope with Principal-Based Buying in Recession

Meta advertising has been evolving in the dynamic marketing and ad-buying space ecosystem. Currently, Meta is moving with principal-based trading in the digital landscape. Understanding the complex situation, its reverberations around the advertising process, and the consequences on media planning is significant.

Principal-based trading is a controversial topic, and when a giant like Meta, which has antitrust lawsuits piled up in a sack, makes it worse for the marketing and advertising industry.

Now, Meta is playing agency and ad tech middleman, not just a social platform. That’s a massive change in role and raises questions about transparency, media value, and neutrality in optimization.

Let’s dive deep into the roadmap for meta advertising and consider what the shift could mean for advertisers and brands.

Science behind principal-based trading in meta advertising

We will take off by explaining principal-based trading.

It’s not just a textbook definition; it’s a full-on business model overhaul that directly impacts agencies and advertisers.

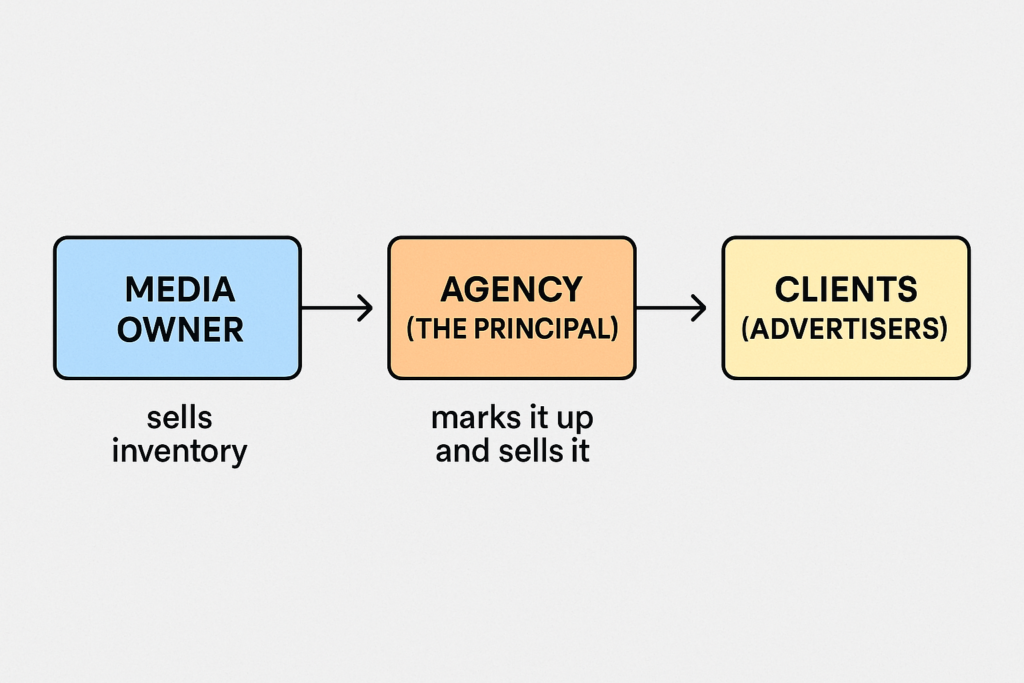

Here’s the basic structure: a media owner sells ad inventory to an agency (the “principal”), then marks it up and resells it to advertisers. In this new model, Meta becomes the principal. On its terms, it buys ad inventory or placements from third-party websites, publishers, and apps.

Think of a popular mobile game like Candy Crush. In this case, Candy Crush is the publisher offering ad slots. Meta buys those ad slots in bulk through its Meta Audience Network partnerships or SDK integrations, then resells that space to brands—Nike, Coca-Cola, or even SMBs—running campaigns through Meta Ads Manager or Advantage+.

So now, Meta isn’t just selling space on Facebook or Instagram. It’s bundling and reselling external inventory that it technically owns for the duration of the ad deal. It’s holding the media and playing gatekeeper, controlling where your ad shows up and how much you pay for it.

Andrew Tindall, VP at System1, summed it perfectly in his LinkedIn post.

Subscribe to our bi-weekly newsletter

Get the latest trends, insights, and strategies delivered straight to your inbox.

He highlighted how principal-based models can be incredibly profitable for both the platform and the agency. The model guarantees steady revenue and introduces margins that agencies (and now platforms like Meta) get to control.

As Tindall noted, this practice is part of what originally split off media from creative in the first place, giving rise to number-driven media agencies with a razor-sharp focus on buying and optimization.

Untransparent transparency in Meta advertising

We are facing a black box when it comes to transparency.

With Meta stepping into principal-based trading, ad pricing just got a new layer of fog. In principal-based trading, Meta becomes both the media buyer and the media seller. It allows them to control the pricing, mark up the inventory, bundle it with optimization features, and serve it to you as a performance product.

Sounds convenient. Until you realize the challenges of deciding and decoding the real price.

As an advertiser, you will be questioning:

Was that $10 CPM really worth $10?

Was my ad placed where it performs best—or where Meta makes the most margin?

Is my brand being optimized for performance or Meta’s profit?

This opacity creates a conflict of interest as Meta holds the media, runs the auction, controls the data, and reports the performance. That’s a lot of hats for one player to wear.

Agencies have been called out for this before, but when a trillion-dollar tech giant starts playing principal, it sends ripples through the entire industry.

Without adding any controversy, Meta is already facing antitrust heat—from the FTC, the EU, and privacy watchdogs globally. Adding principal-based trading into the mix only deepens the concern: Is this another move to consolidate power, squeeze out independent publishers, and lock advertisers deeper into its walled garden?

Impact on media planning and creativity due to Meta Advertising plans

Meta’s jump into principal-based trading alters the buying model and blows up the clarity that media planners rely on. Traditionally, planners work with clear-cut roles: the agency strategizes, the platform serves, and the publisher delivers.

When Meta becomes the principal, seller, and optimizer, it’s more complicated than ever for planners to track where ads run. Was that pre-roll on a premium gaming app or buried in a random quiz app with no contextual relevance? Who knows? Meta holds the placement details, the pricing structure, and the performance reports. And you trust that it’s all been optimized “for you.”

For advertisers used to controlling audience, context, and placement strategy, this is a power shift. A big one. Media planners, who once decided where and how budgets should be allocated, are now being nudged aside by Meta’s algorithms, which promise performance, but don’t offer much insight into the mechanics.

We’re entering an era where planning is automated, and the planner’s role becomes reactive. Instead of asking, “Where should we be?” brands are forced to ask, “Where did we land?”

Meta isn’t just challenging agencies here—it’s absorbing their functions, turning media planning into a back-end process that’s optimized on Meta’s terms. The result? Less transparency, customization, and strategic control in the hands of brands and planners.

Creativity gets dragged, too

While the media planning department faces shrinking roles, there is mounting pressure to perform. When Meta becomes the principal, performance becomes the product, and creativity?

With Meta optimizing ad placements across spaces it already owns or has bulk-bought, the entire system is wired to favor what performs on paper. It’s a loop of safe, conversion-driven creativity built to game the system, not spark emotion. Brands are left creating content for machines, not people.

That’s not to say great creatives can’t survive. But it now has to fight harder, louder, and faster in an ecosystem where creativity isn’t prioritized—performance is.

Principal-based trading is a sign of recession

In the time of tariffs, brands are tightening their belts on media spending. Every dollar has to stretch. Every impression needs to count. That’s why “efficiency” becomes the magic word during ad downturns.

Suddenly, principal-based buying gives power to publishers and agencies.

The recession squeeze makes advertisers more vulnerable to this setup. Budget cuts often mean skipping third-party audits, cutting back on media buyers, or ditching external verification tools. And that’s precisely when platforms like Meta thrive: when control gets traded for convenience.

Meta is capitalizing on a moment when brands are stretched thin and more likely to trust turnkey performance over scrutinized planning.

Meta advertising doesn’t give a happy-go-lucky vibe but may look shiny, seamless, and efficient. But before brands’ advertisers step deeper inside, let’s pause and ask the one question.

Cut to the chase

Meta advertising isn’t just shifting the rules of advertising, it’s bending them around its own reflection. By stepping into principal-based trading, Meta is now shaping how ads are bought, where they appear, how they’re measured, and ultimately, how brands show up in the world.