Global Ad Spend Forecast Hints at the Growth of Retail Media and CTV

As 2025 unfolds, it’s clear that this year will take a different trajectory than the action-packed 2024, marked by the Olympics, Paralympics, elections, and other major events. The impact will be visible on global ad spend. While key events and milestones drove significant spikes in media spending for the year 2024, 2025 promises steady progress and consistent advancements in the global media landscape.

When we talk about steady advancements, we’re not hinting at a slowdown or stagnation in the growth that brands have achieved. Observing the market’s current growth stats is essential because that’s how advertisers, CMOs, and brands can decide what to expect.

Meanwhile, this year is set to showcase powerful catalysts and key drivers shaping global media ad spending. Dentsu’s comprehensive Global Ad Spend Forecast offers valuable insights into these forces and provides a clear roadmap for brands, CMOs, and marketing professionals looking to navigate and optimize their strategies.

Let’s dive into the report’s details to uncover the key factors influencing media spending in 2025.

Media spending on the rise is a strategic imperative for CMOs in 2025

A striking 89 percent of CMOs are preparing to increase media ad spending, recognizing media as a critical driver of business growth. This optimism comes against a backdrop of geopolitical and economic uncertainty, highlighting the strategic importance of media in navigating turbulent times.

The latest World Economic Outlook from the International Monetary Fund (IMF) projects global economic growth at 3.2 percent for 2024 and 2025. However, the picture isn’t uniform across regions. While the overall trajectory appears positive, disparities remain:

- Challenges for Europe: Germany and Italy are projected to experience economic slowdowns due to sluggish manufacturing output.

- Headwinds for Emerging Regions: Sub-Saharan Africa, the Middle East, and Central Asia face lower growth rates driven by internal conflicts, oil production cuts, and the impact of extreme weather.

- Opportunities for Economic Giants: The United States, India, and China are set for brighter prospects, thanks to investments in AI, semiconductors, and robust consumption. The US is forecast to grow by 2.2 percent, India by 6.5 percent, and China by 4.5 percent.

With these predictions regarding economic growth, the media ad spend forecast will be similar region-wise and growth-wise.

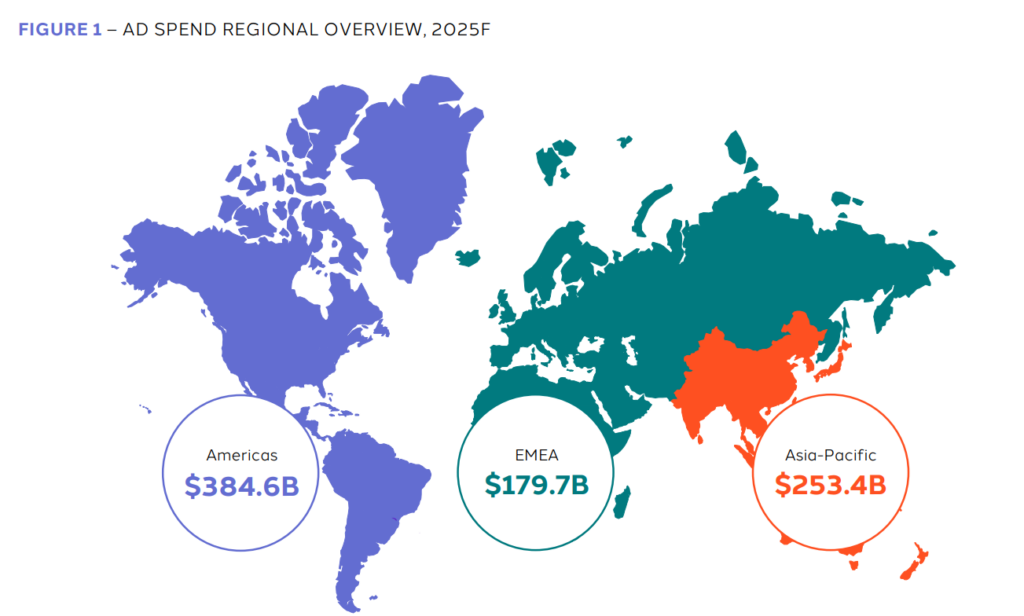

America is the fastest-growing region among America, EMEA, and Asia-Pacific. According to the Dentsu report, US ad spend growth is projected to reach 5.0% in 2025 as streaming, retail media, paid search, and paid social continue to garner increased investments.

Canada has a moderate growth rate in ad spending as broadcast is still the most potent medium. While EMEA shows signs of advancing growth and may reach 5 percent in 2025, Asia-Pacific hints at ad spending forecast to grow by 5.4% in 2024 and 5.8% in 2025 to reach $253.4 billion.

Given these conditions, CMOs are positioning themselves for a year of strategic investment. With 88 percent emphasizing the media’s role as a pivotal growth partner, the focus is on leveraging media to drive brand visibility, engagement, and revenue in a complex economic environment.

Algorithm era is the new frontier for advertising and brands in 2025

According to Dentsu’s projections, by 2027, 79 percent of media or ad spending will be driven by algorithms. Brands now access an overwhelming wealth of data from consumers’ interactions with information, entertainment, and e-commerce platforms.

Yes, algorithms are set to transform the new media and marketing era for brands and agencies alike. It started with broadcast and evolved into the performance and ad tech ecosystem, and now, we have entered the algorithm era where data-driven systems are transforming media planning and consumer targeting.

Therefore, brands’ media strategy should resonate with the available algorithms. But here comes the challenge:

If everyone begins using the same algorithm with the same magnitude and force, saturation will inevitably take over. To avoid such scenarios and achieve optimal results, brands and CMOs must think outside the box and find innovative, specific, and creative ways to leverage algorithms effectively.

Catalysts Driving Effective Media Ad Spend in the Algorithm Era

Digital spending is set to soar in 2025, with a projected increase of 9.2% to account for 62.7% of the total advertising market. As the algorithm era shapes media strategies, CMOs must explore emerging opportunities to drive growth. Key catalysts include retail media, connected TV (CTV), and new media.

Retail Media: Disrupting Traditional and Digital Advertising

Retail media is rapidly transforming both traditional and digital media landscapes. Retailers like Walmart and Amazon Ads have pioneered this space, allowing third-party brands to purchase ad slots on their digital platforms. Experts predict retail media could surpass linear TV by 2025 and paid digital media by 2027.

New players, such as CVS and PayPal, are entering this arena, aiming to set new industry standards. For brands, adapting to this shift is crucial to staying competitive and capitalizing on retail media’s growing influence.

Broadcast Media: Still in the Game

Despite predictions of decline, broadcast TV remains a relevant player. In 2024, ad spending saw a boost due to global events like the Olympics and elections. Although 2025 lacks such high-profile events, it’s too early to discount broadcast media entirely.

CTV, the emerging counterpart to traditional TV, is experiencing robust growth. Platforms like Netflix and Prime Video are expanding their ad offerings, contributing to an anticipated 18.4% growth in CTV ad spending in 2025. However, the plethora of streaming platforms—from subscription-based services to free options like Tubi—creates a complex landscape for advertisers and consumers. Brands must adopt data-driven strategies to identify the most effective platforms and ensure measurable returns.

New Media: A Rising Star

New media encompasses audio platforms, digital out-of-home (OOH) advertising, and traditional print media. Podcasts and audio platforms have become indispensable, providing brands with new avenues for engagement.

OOH advertising is also experiencing growth, with a projected 3.9% increase in 2025. Digital OOH is particularly prominent, accounting for 67% of media investments in the UK. Even traditional print media holds value, maintaining significant consumer trust.

A Multi-Channel Strategy for the Algorithm Era

In an age defined by technological advancement, a multi-channel approach is vital. Brands must strategically integrate retail media, CTV, and new media into their marketing strategies to ensure relevance and capitalize on the algorithm era’s opportunities. By diversifying their investments, brands can effectively navigate a competitive and ever-evolving media landscape.

Cut to the chase

Dentsu has published its Global Ad Spend Forecast 2025 report, predicting the rise of the algorithm era and slow but steady growth. However, in the wake of the report, various driving forces could increase the potential for media ad spend investments. CMOs anticipate a rise in media spending, while both the digital realm and traditional media are looking ahead to 2025 with optimism.