Unilever Unleashes Armageddon of Influencer Marketing in 2025

Influencer marketing has become the talk of the town in 2025 for multifarious reasons. One of the biggest advertising and marketing brands, Unilever, has adapted to a new strategy in which half of its media spending is assigned to influencers and creators.

We all know a lot has been happening in the marketing industry since the start of the year—political showdowns, social backlashes, brand isolation, DEI shutdowns, shadow protests, and tariff turbulence. Amid all this, Unilever replaced Hein Schumacher with Fernando Fernandez, an Argentine executive with decades of experience at the company.

Now, the new CEO of Unilever is making fast decisions based on real data and real scenarios. We will dig deep and spill the tea on Unilever and its marketing strategy.

How restructuring Unilever led to reshaping the marketing strategy

Replacing Hein Schumacher before the completion of his two years as CEO with another company executive hinted at a desire for fast growth and conversion through restructuring. However, a Unilever statement said the decision was by mutual agreement between the board and Schumacher.

Fernandez came out strong with a pro-influencer marketing attitude. His initial remark was fascinating. Quoting Fernandez:

“There are 19,000 Zip codes in India. There are 5,764 municipalities in Brazil. I want one influencer in each of them.”

In a conversation with Warren Ackerman of Barclays, Fernandez expressed his desire to rethink Unilever and its brands’ marketing approach. His words described traditional marketing as ‘skeptical’ for new-age consumers.

New-age consumers indicate Unilever is targeting Gen Zs, young Millennials, and even Alpha Gens. He announced that the move will see media spend on social channels rise from about 30 to 50 percent of the total budget and that the company will look to work with 20x more influencers.

Meanwhile, it made me wonder about the decision of such a brand that has shown streaks of creativity and sparked conversations with its unconventional ad campaigns over the years. How could you just brand traditional advertising channels as suspicious?

The answer lies in logic and current market situations.

Tariffs are paving the way for influencer marketing

In Ad Pulse’s detailed report ‘Tariffs Effects: Alarming or Alluring on the Marketing Industry,’ we predicted that traditional advertising—including TV, print, and big media buys—can be expensive and rigid. Brands under budget pressure start looking for lower-cost, higher-agility alternatives.

However, Unilever has not cut down on media spending. However, adopting a social-first strategy shows that the new CEO is taking very calculated steps.

Influencer marketing can be more targeted, cost-efficient, and performance-driven than traditional media. Social media platforms like Meta, YouTube, and TikTok are poised to benefit. Their focus on creator monetization and performance targeting makes them appealing channels for brands seeking cost-effective advertising solutions.

Unlike physical goods, digital services like influencer content, social media activations, and creator partnerships are largely unaffected by tariffs.

Unilever scopes new and modern potential consumers

Unilever’s Cif Cleaner campaign in 2024 revolutionized new markets and affluent shopper groups, especially millennials and Zoomers.

In 2023, cleaning influencers were already shaping the viral #CleanTok trend. One year later, Unilever inserted itself into the conversation with its cheeky ‘Satis-hack-tion‘ campaign—real-life cleaning videos set to Italian DJ Benny Benassi’s iconic track ‘Satisfaction,’ re-recorded with lyrics tailored to Cif.

Cif tapped a new market and a fresh audience segment, from France to the UK and Brazil. The white sneaker cleaning trend in the UK led to a 38 percent spike in purchases among adults under 28. This kind of payoff is exactly why Fernandez is doubling down on a social-first strategy. It’s not just a random bet.

It’s informed by experience and a deep understanding of how modern consumers move. Unilever knows that social media platforms have become the top discovery channels for today’s audiences. Instagram, TikTok, YouTube, and Reddit are replacing the good old Google search bar with visual, interactive, and instantly satisfying answers.

Millennial parents are raising Zoomer and Alpha Gen kids. These three generations are deeply plugged into the digital world.

Sure, we might set millennials a bit apart, but the truth is that ’90s kids had their socials, too.

Zoomers have inherited their parents’ browsing and searching habits, while Alpha Gen, the youngest of all, has never even blinked away from the internet.

They don’t want to search. They want to scroll. They want to play. They want to interact.

These digital-native consumers aren’t going anywhere. They’re growing. And brands that invest in creator-driven relationships today are betting on a lifetime of loyalty in return.

But not every bet is safe. The strategy has cracks, and ignoring them could turn the game upside down.

Factors that make the strategy backfire

“Influencer marketing can be more difficult to track than traditional marketing and advertising because of the latter’s clear-cut metrics.”

Devin Partida, Editor-in-Chief of RedHack, in a recent article

Her point strikes a nerve. The sheer scale of Unilever’s influencer investment doesn’t just feel ambitious. It almost feels desperate. That’s exactly why marketers must pay attention to what’s glowing and glaring.

Three major issues threaten to undermine the whole plan: Measuring influencer impact, tracking return on spend, and aligning every piece of content with Unilever’s brand expectations. These are not minor tasks.

They are the difference between success and a marketing nightmare.

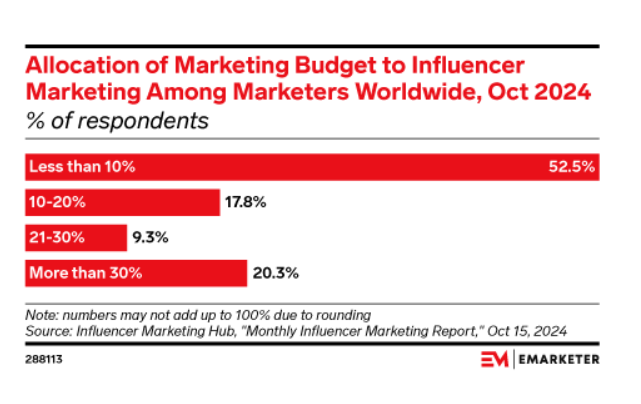

Experts at eMarketer have already voiced the concern.

When managing a brand portfolio as broad as Unilever’s, keeping tabs on how each influencer reflects your brand values is a tall order. And putting so much weight on a single marketing strategy without balancing others?

That’s risky territory, even for an industry veteran like Unilever.

The success of social-first strategy and industry trend

After Unilever boldly announced its social-first marketing strategy, Dove wasted no time scooping up April’s Joy of Digital Award with its creator-led campaign #ShareTheFirst—a global call to ditch filters and embrace unedited beauty in a world obsessed with retakes and re-edits.

Created in partnership with Edelman, the campaign featured a diverse group of creators encouraging people to #ShareTheFirst snap they take before filters, before angles, before second-guessing creeps in. It launched with a striking digital takeover of Liverpool Street Station, placing real, raw beauty in one of the busiest public spaces.

While discussing social-first strategy and influencer investment, Unilever isn’t alone. Other legacy brands are stepping in with their playbooks.

Nescafé recently teamed up with Zach King, the wildly popular digital illusionist and filmmaker, making him their first-ever global influencer. Up until now, the brand has leaned on on-screen celebrities. But now? It’s all in on creators.

Zach King is a digital powerhouse with over 185 million followers worldwide and the Guinness World Record for the most-viewed TikTok video, clocking in at a mind-blowing 2.2 billion views. That’s the reach traditional media can only dream of. Nescafé knows the stakes and is ready to play in the new arena for young, digital-native consumers.

The next generation of consumers doesn’t want to be sold to. They want to be spoken with, laughed with, and understood. In 2025, that kind of connection will live on social media.

Cut to the chase

Unilever’s pivot to influencer marketing signals that the influencer economy is maturing. With platforms like TikTok and YouTube replacing the traditional search bar and creators becoming more powerful than primetime ads, brands can no longer sit on the fence.