The Domino Effect: How Tariffs Are Disrupting Global Advertising Spend in 2025

We don’t typically think of advertising agencies or marketing budgets when we hear the word “tariffs. Instead, we think of trade negotiations, shipping containers, or global politics—no advertising spend. But behind closed doors, that’s exactly where tariffs are quietly making their impact on how brands are spending on advertising .

Tariffs are essentially taxes on imported goods, introduced to protect domestic industries. However, as those additional expenses spread throughout global supply chains, they begin to impact every aspect, from manufacturing and product pricing to the amount of money that brands are willing to spend on marketing.

And the effects are increasing. A 2025 survey by the Interactive Advertising Bureau (IAB) found that 94% of marketers are concerned about the impact of tariffs on advertising budgets, with many already seeing spending cuts of 6% to 10%. It’s not a crash, but it’s a cautious, widespread tightening of belts—and some sectors are feeling it more than others.

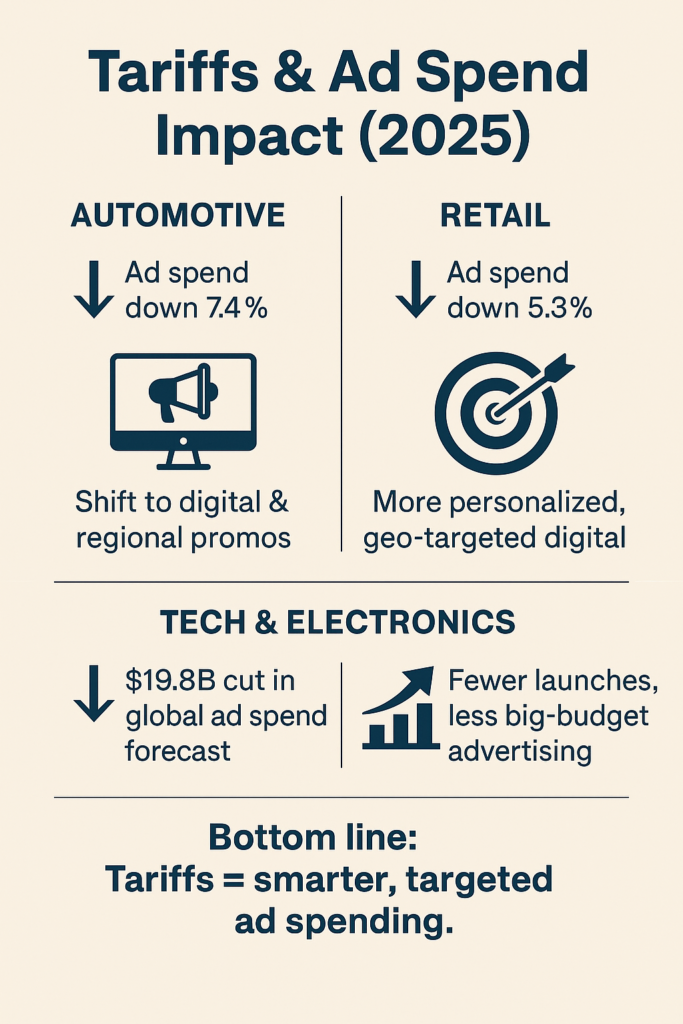

Sector by sector: Where the cuts are happening

While the overall dip in advertising spend might seem modest, the impact of tariffs varies sharply by industry. Compared to other industries—some are making more drastic changes to their tactics, shelved campaigns, and ROI priorities. Let’s examine the actual situation to see where the dominoes are falling.

Automotive Industry

Few sectors rely more heavily on global supply chains than automotive. With tariffs increasing the cost of imported components, car manufacturers are under pressure to protect shrinking margins.

Rather than raising prices across the board and risking lower sales, many automakers are pulling back on one of their biggest flexible expenses—advertising. According to WARC’s Q1 2025 report, the auto industry cut advertising spend by 7.4%, shifting from big-budget TV campaigns to more efficient, digital-first strategies focused on performance.

Brands like Ford and Stellantis are reportedly reallocating media dollars to retargeting and regional promotions instead of splashy national commercials.

Retail Sector

Retailers—especially those in apparel and electronics—are facing a double squeeze: higher import costs and inconsistent inventory levels. Due to tariffs on everything from fabrics to finished devices, brands must spend more to fill their shelves, leaving less money for marketing.

As a result, this has led to a 5.3% decline in global retail advertising spend. In response, companies are increasing their use of digital platforms that yield measurable returns on investment. Personalized email campaigns, search ads, and influencer micro-campaigns are now replacing mass-market efforts. Some, like Walmart and Target, are also geo-targeting promotions based on inventory availability in each region.

Technology & Electronics

Important sectors like tech and electronics have been hit hard by the raised tariffs on semiconductors and components, mainly from Asia. Production delays are becoming more frequent as parts become more expensive and more difficult to find, particularly for mobile devices and smart home items.

WARC’s Q1 2025 update reflects this strain, slashing global ad spend forecasts by $19.8B. Growth is now projected at 6.7% for 2025 and 6.3% for 2026. Unsurprisingly, fewer product launches mean fewer campaigns. Advertising growth in the tech sector has now slowed to half its previous pace, with many companies holding off on large-scale investments until supply chains stabilize.

Big players are feeling the pressure too

It’s not just brands who are withdrawing, but the advertising agencies are feeling the pressure too.

WPP, one of the world’s largest agency groups, reported a 2.7% decline in revenue in Q1 2025, citing client reductions brought on by tariffs and other macroeconomic concerns. Smaller retainers, delayed project work, and heightened examination of marketing ROI are the outcomes of this trend.

But it’s not all bad news. The changes are forcing a mindset shift and driving people to adopt a new way of thinking and adjust their perspective from “spend big” to “spend smart”. In their advertising, brands are becoming more flexible and strategic, concentrating on what works rather than what creates the most buzz.

Smarter Spending: How brands are adapting

Instead of going dark, many brands are choosing to get smarter with their ad dollars. Faced with tighter margins, they’re rethinking not just how much they spend—but how wisely they spend it. The result? Smarter choices and more focused ads.

Performance-Based Advertising on the Rise

With tighter budgets, advertisers place bets only where they see clear returns. Performance-based advertising is therefore becoming more popular on websites like Meta, Google, and TikTok. Brands are pursuing conversions rather than impressions.

Agencies report a major shift toward measurable KPIs: click-throughs, sales, and engagement. Campaigns are being optimized daily, and many companies are testing small, targeted ideas instead of launching expensive, top-of-funnel media buys.

Inventory-Synced Ad Campaigns

A practical shift is happening, too. Several firms are aligning their advertising campaigns with supply chain upgrades to cut down on wasteful spending. For example, Foot Locker now uses AI to link marketing promotions to real-time inventory levels. If a sneaker is out of stock in one region, the system automatically pauses ads for that product in that area.

That’s not just smart media planning—it’s a better customer experience.

Local, Digital-First Strategies

As global campaigns faces new hurdles, to deal with it brands are going local. More control and agility are provided by region-specific initiatives, which enable businesses to respond quickly to changes in the supply chain or unexpected spikes in local demand.

This digital-first approach is also more scalable. Instead of spending a lot of money on national media buys, marketers are choosing to use customized email promos, neighborhood influencer programs, and targeted social media ads.

Less splash, more strategy: A global slowdown in Ad spend

There’s also a clear move away from “vanity” campaigns and toward performance-driven, ROI-focused strategies.

Every dollar invested today needs to provide results, whether it’s through influencer partnerships, search engine marketing, or meta-advertisements. With this brands are constantly refining, running smaller tests, and leaning on data to guide every move.

And the shift is reflected in the bigger picture. According to the latest WARC outlook, global advertising growth has already been revised down by $20 billion in 2025, thanks in part to trade tensions, tariffs, and an unpredictable global economy.

Still, marketers aren’t panicking. They’re evolving. Tariffs may tighten budgets, but they’re also forcing brands to experiment, analyze, and get creative. It’s no longer about how big your campaign is—it’s about how smart it is.

Not a crash, just a careful rethink

While tariffs were introduced to protect domestic industries, they’ve sparked a series of unexpected budget decisions across sectors. Advertising spend—one of the more flexible areas—has become an early adjustment lever for companies looking to absorb new costs.

However, tariffs have prompted a recalibration rather than trigger a collapse in marketing activity. Brands are prioritizing efficiency over extravagance, performance over prestige, and adaptability over tradition.

The advertising world isn’t shrinking—it’s growing and evolving over time. The smartest brands will be those that continue to listen, test, and adapt—one domino at a time—to changing trade regulations and economic challenges.

Cut to the chase

Tariffs are quietly rewriting the rules of ad spending. To stay competitive, brands are leaning into data-driven decisions and tailor-made strategies that actually move the needle. Additionally, companies that are willing to adapt to new trends will become more resilient and stronger. If you want to future-proof your marketing budget? Let’s explore the smartest moves together.